child tax credit portal says pending

10200 unemployment tax break IRS p. This generally will be the address on your most recent tax return or as updated through the Child Tax Credit Update Portal CTC UP or the United States Postal Service USPS.

We both received letter 6419 and received 900 each over the last 6 months for a total of 1800.

. WFXR Starting July 15 parents of children 17 years old and younger will begin receiving monthly payments from the Internal Revenue Service IRS. After talking to the IRS and finding out this was a glitch and happened to others I had some hope but there is still no change as of today. Am I not understanding this correctly or.

Also all of my direct deposit information is gone and theres not even anywhere to update it. I received the child tax credit last month by direct deposit. The Update Portal is available only on IRSgov.

The tool also allows families to unenroll from the advance payments if they dont want to receive them. I am qualified and received the first letter. Free means free and IRS e-file is included.

My amended return was accepted but not processed and my CTC portal says pending will not receive advance payments. I dunno whats going on. Why does my child tax credit say pending opt out of child tax creditWatch Our Other VideosIRS unemployment tax refund.

Households that claim children as dependents on their taxes. I received July and August just fine but early September the portal changed to pending eligibility. Still shows Im eligible.

You qualified for advance Child Tax Credit payments if you have a qualifying child. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Child tax credit portal says pending Friday March 11 2022 Edit.

I logged in irs portal and now it says pending but I got the other 3 payments. New Member July 11 2021 505 PM. Recipients can check the status of the monthly payment at the IRS Child Tax Credit Update Portal.

The payments are part of th. I got all other stimmies fine. I think its because I filed an amended return in 2020 but my tax return status says that Im good to go.

Portal still says pending eligibility. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined. In the same boat.

Now I never got the payment yesterday and when I go into the portal it says pending eligibility. I have an amended return not sure if this is why. For more information regarding CTC UP see Topic.

Does anyone elses child tax credit portal say pending eligibility. My status on IRS portal says my CTC is pending. Gst Portal Problems Face Flak From Filers Date Extended By 3 Days Goods And Services Goods And Service Tax Indirect Tax Form 26as How To Download Form 26as From Traces Tax Deducted At Source Income Tax Income Tax Return.

Topic E if the IRS has not processed your 2020 tax return as of the payment determination date for a monthly advance Child Tax Credit payment we will determine the amount of that advance Child Tax Credit payment based on information shown on your. If the portal says a payment is pending it means the IRS is still reviewing your account to. Enter your information on Schedule 8812 Form.

I usually get it a day early. But did not receive Septembers and nothing pending or showing to be sent out this month either. Pending for last month and still pending this month.

Originally they said it was being mailed but I fixed it and still got the direct deposit. To reconcile advance payments on your 2021 return. You will not receive advance payments at this time then watch my.

My wife and I have one child. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Max refund is guaranteed and 100 accurate.

Omg I received the first 2 months but not September or October says pending eligibility. The next monthly payment is slated to go out at the end of this week around Oct. Also you or your spouse if married filing a joint return must have had your main home in one of the 50 states or the District of Columbia for more than half the year.

My 2019 taxes were filed on time so if its going off that tax year there should be no delay. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Watch your mailbox or bank account in mid-October.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. The Child Tax Credit Update Portal is no longer available. Get your advance payments total and number of qualifying children in your online account.

You can no longer view or manage your advance Child Tax Credit. TurboTax says when I enter that info that we should receive the other 1800 for a total of 3600 for the year however that amount is not reflected in our refund when I enter it. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

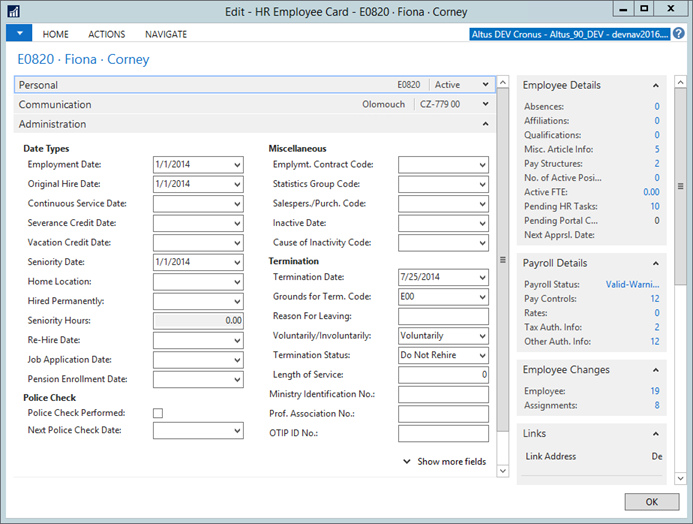

Criminal Record Checks Cpic Commissionaires

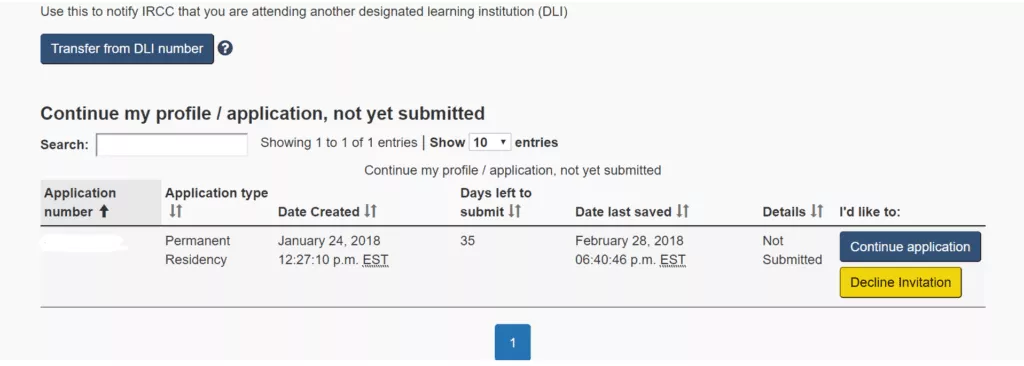

Lola Delgado S Online Student Portal

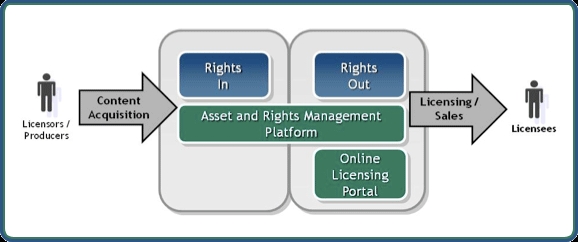

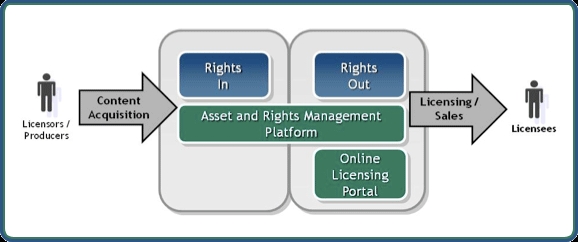

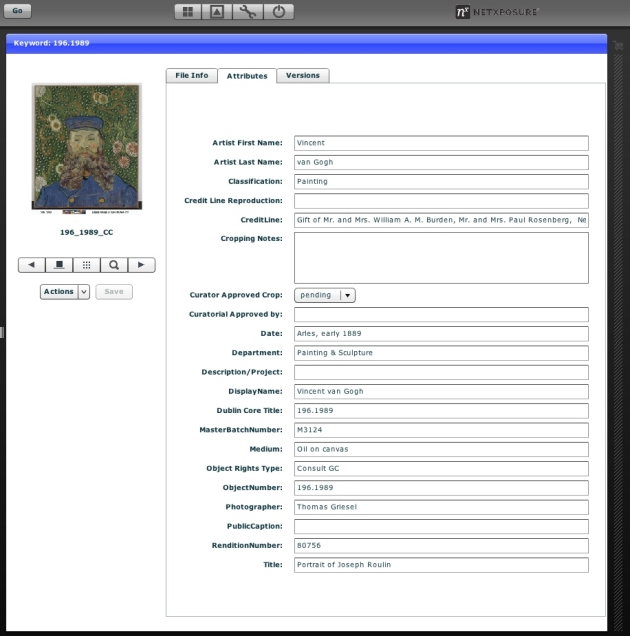

A Museum Guide To Digital Rights Management Canada Ca

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

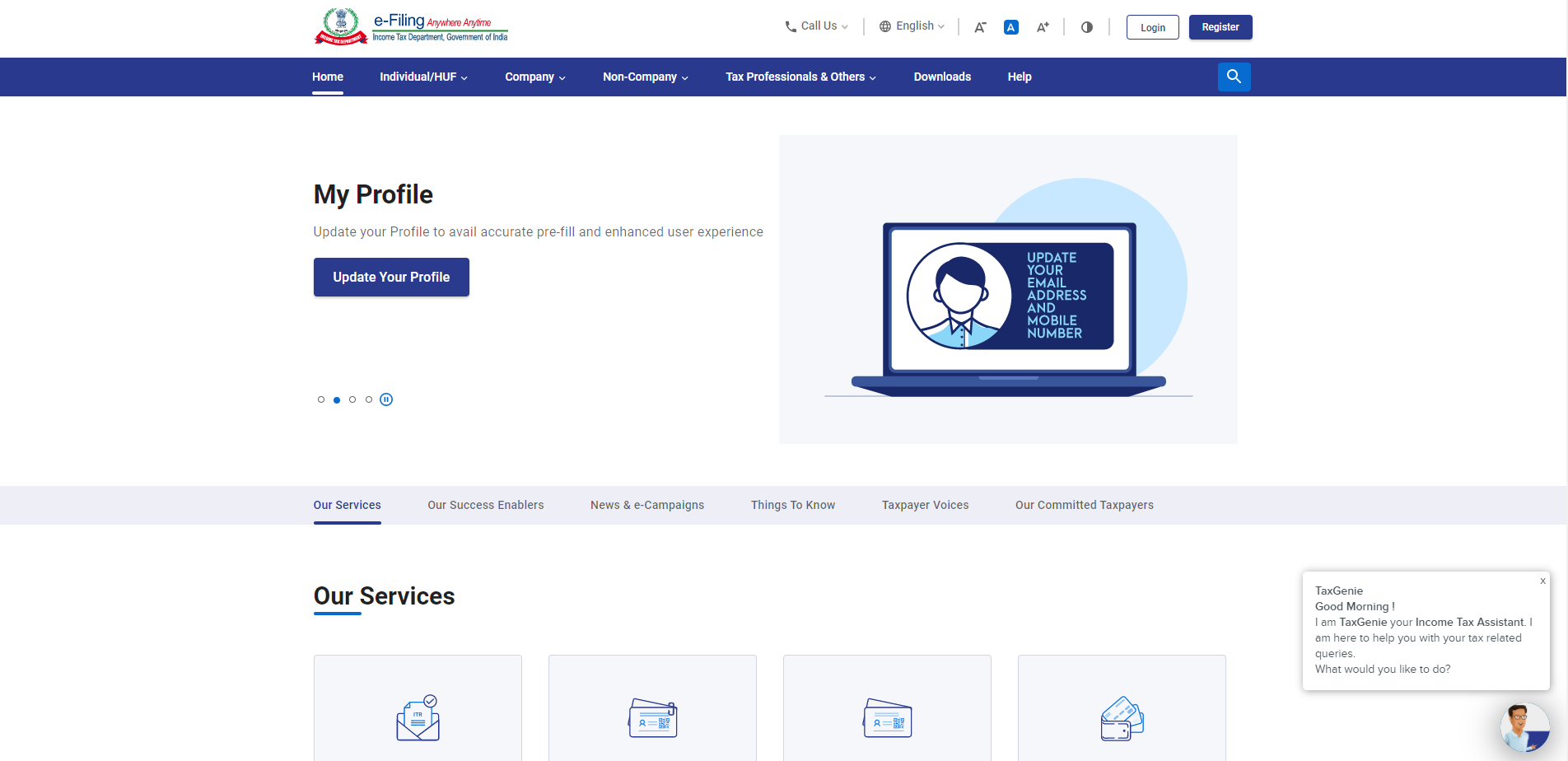

How To Download Json Utility From Itd Learn By Quickolearn By Quicko

Certified Process Server Looking For Legal Document Services Process Server Express Offers The Finest Services Like Le Process Server Paralegal Roseville

A Museum Guide To Digital Rights Management Canada Ca

Ka 02229 Customer Self Service

What Does Application Sent To Pfms For Payment Mean In National Portal Scholarship Quora

Post Ita Documents List For Canada Immigration Ask Kubeir

How To Download Json Utility From Itd Learn By Quickolearn By Quicko

Helpful Information For Filing Taxes As The Deadline Approaches Canadian Immigrant

What Does Application Sent To Pfms For Payment Mean In National Portal Scholarship Quora